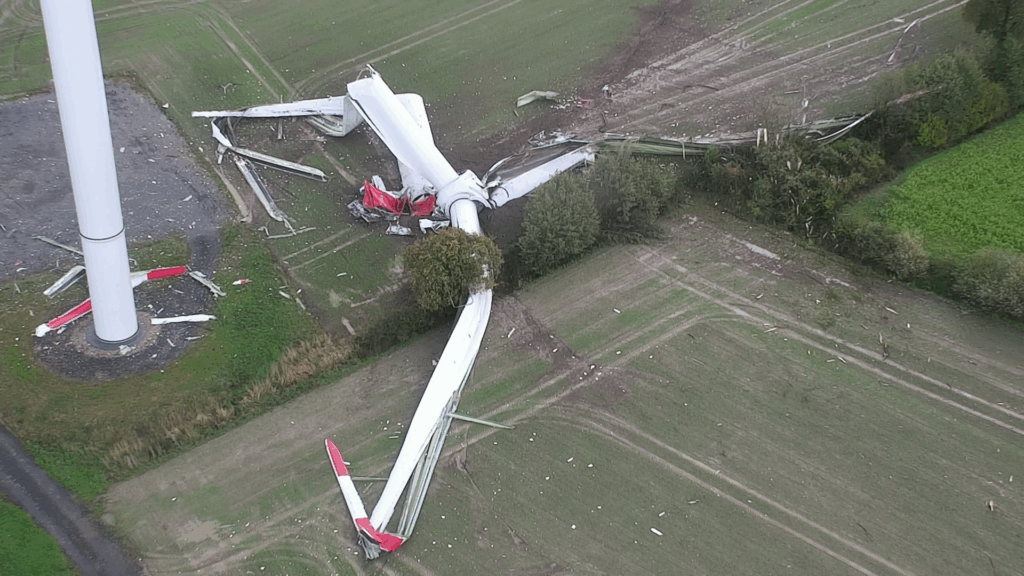

In Havixbeck, a serious accident involving a Nordex N149 wind turbine has caused a stir. The wind turbine collapsed at the end of October, severely damaging the Herkentrup wind farm. Over 100 investors and shareholders, who are involved through subordinated loans as part of a citizen participation scheme, are now worried about their money and the corresponding profit distribution. For safety reasons, the Coesfeld district authorities ordered two identical turbines to be shut down – the entire wind farm is currently at a standstill. (wn: 28.10.25)

Cause of the accident still unclear

The cause of the accident remains unclear. Experts are investigating whether a technical defect, an assembly error, or a design problem triggered the collapse. As a precaution, the Coesfeld district authorities ordered the shutdown of two identical wind turbines operated by the same company in the Münsterland region. The entire wind farm will remain out of operation until the cause is determined – a major setback for investors.

Image: Feuerwehr Havixbeck

Over 100 residents of Havixbeck jointly invested around one million euros. The project developer specifically offered subordinated loans to local residents to mitigate resistance to the construction of the wind turbines. The promised citizen participation was intended to allow residents to profit from the returns – now, this very model is causing unrest among the investors.

Investors fear losses after the turbine failure

Many investors are wondering whether their dividends for the current year are still secure. As long as the affected wind turbine and the other shut-down turbines remain idle, no electricity is produced – and therefore no revenue is generated. Although the damage occurred within the two-year warranty period, as the wind farm only went into operation in February 2024, even if Nordex covers the replacement or repair costs, longer downtimes and lower payouts are still a threat.

The turbine failure comes at a time when confidence in citizen energy projects is already under pressure. Even modern wind turbines are not without risks, as the case in Havixbeck impressively demonstrates.

Subordinated loans as a risk for investors

Experience from similar cases shows that months-long downtimes are possible after a turbine failure. This not only reduces returns but also jeopardizes overall profitability. Subordinated loans are generally considered risky because they are repaid only after other creditors in the event of insolvency. If the operator runs into financial difficulties, investors face significant losses – up to and including total loss.

The structure originally intended as citizen participation is thus proving to be a double-edged sword: on the one hand, it strengthens local acceptance, but on the other hand, it carries a high risk. Particularly in the case of technical malfunctions like this turbine failure, it becomes clear how vulnerable such models are.

Loss of confidence following the accident

The accident in Havixbeck not only exposes technical weaknesses but also the financial risks of community wind power projects. While the authorities are still investigating, investors are increasingly worried about the prospect of missed dividend payments. Many investors are wondering whether they will ever see their invested capital again.

The destroyed wind turbine symbolizes the vulnerability of the energy transition at the local level. Despite the guarantee, it remains unclear when dividend payments will resume – and whether investors’ confidence in green investments will return.