With the closure of the last silicon production facility in Germany, the gap between political ambition and economic reality has reached a new peak. For years, the German government has emphasized a more independent raw materials policy, a stronger industrial policy, and less dependence on China. Yet, in Pocking, the last German silicon factory is closing for good. High energy prices are hampering competitiveness. Hardly any event illustrates the contradiction between political promises and reality more clearly than this industrial retreat.

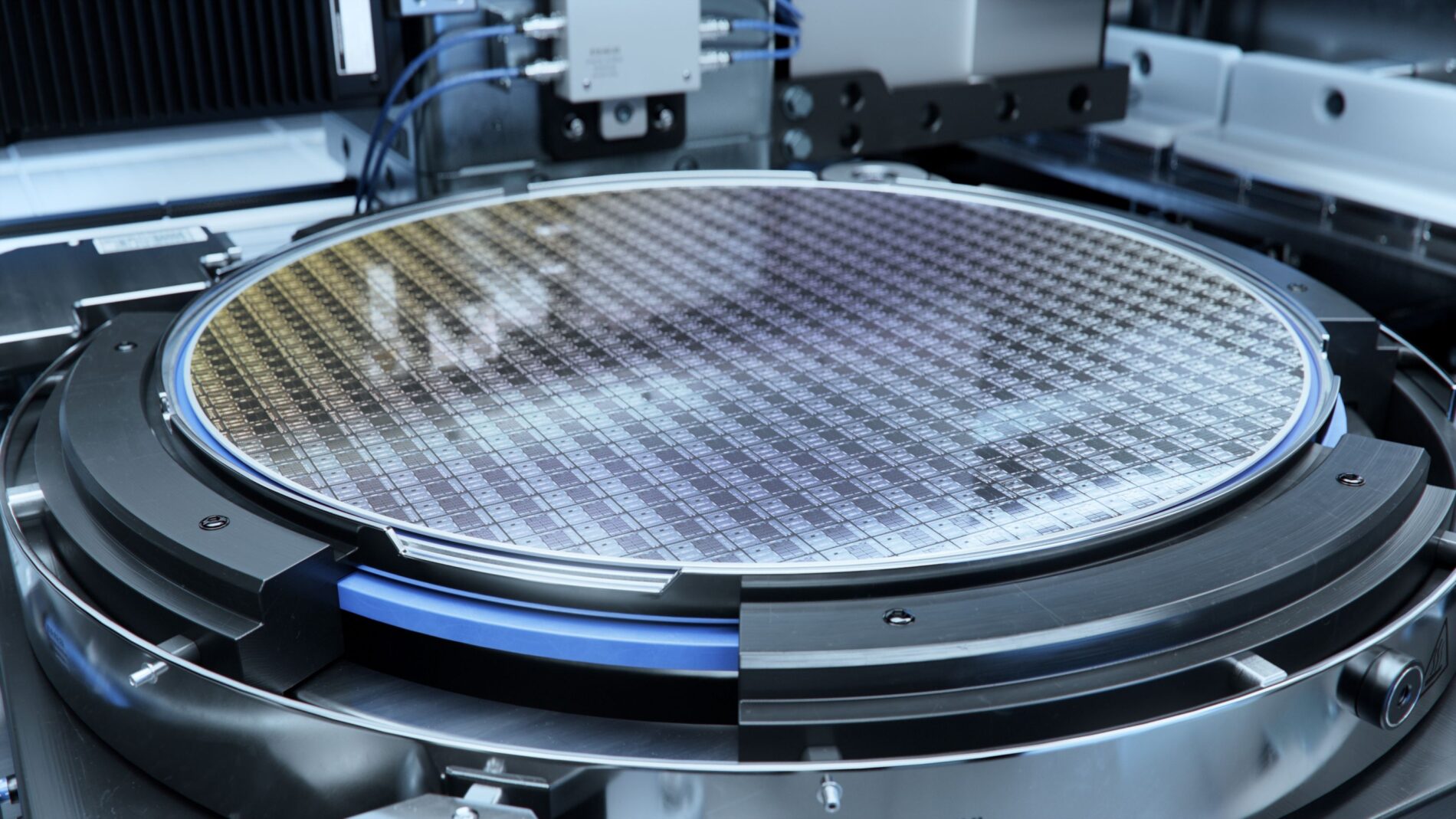

Silicon is at the heart of the strategic debate.

Silicon is considered a key material for modern economies, because without it, neither semiconductors nor solar modules nor battery systems can be manufactured. Nevertheless, the last domestic production facility will close at the end of the year.

For the approximately 110 employees of RW Silicium, the decision represents a profound loss, especially since they were informed of it just before Christmas. The board of the parent company cites a lack of economic prospects, despite years of rescue attempts. As a result, Germany is losing not only jobs but also technological expertise.

Raw Materials Policy Remains a Political Promise

After the closure, German industry will be left with imports as its sole source of raw materials. This development contradicts the stated goal of a more robust raw materials policy intended to reduce strategic dependencies. This issue is gaining particular importance in relation to China, as the global silicon market is already heavily dominated by Chinese suppliers. While political strategy papers promote autonomy, a real production base is disappearing. This discrepancy significantly weakens the credibility of government pronouncements.

Energy Prices Undermine Industrial Policy

The decisive cost driver is not the raw material. High-purity quartz is readily available and, in Pocking, even originates from the region. The decisive factor is energy prices, as the conversion to metallic silicon requires enormous amounts of electricity. Analyses clearly show that regional electricity costs determine success or failure. This is precisely where industrial policy falls short, due to a lack of competitive framework conditions. As a result, the production of this material has lost its economic foundation, although its strategic importance remains undisputed.

Global Markets Intensify Pressure from China

Even in economically stable times, the Pocking site achieved only a small share of the global market. China already dominated the market then and has continued to expand its position. After the pandemic and energy crisis, prices collapsed, while overcapacities from Asia distorted competition. Silicon recently entered the global market significantly below production costs. Compared to the US, which is responding with high tariffs, Europe remains hesitant. This asymmetry further exacerbates the location’s disadvantage.

A Pattern Beyond the Individual Case

The closure in Pocking is not an isolated case. Other European sites are also coming under pressure, even though they are working with climate-friendly technology. Companies report ruinous competition, inadequate protective instruments, and a lack of coordination between trade and industrial policy. While new projects receive subsidies, support for maintaining existing capacities is lacking. This not only leads to a loss of industrial substance but also erodes trust in political commitments.

Aspiration and Reality Drift Further Away

The closure of the last silicon factory demonstrates how far political objectives are from implementation. Raw materials policy promises security of supply, industrial policy speaks of resilience, yet high energy prices and global market disruptions are driving key industries out of the country. As long as this contradiction persists, strategic autonomy remains a buzzword without foundation. (KOB)