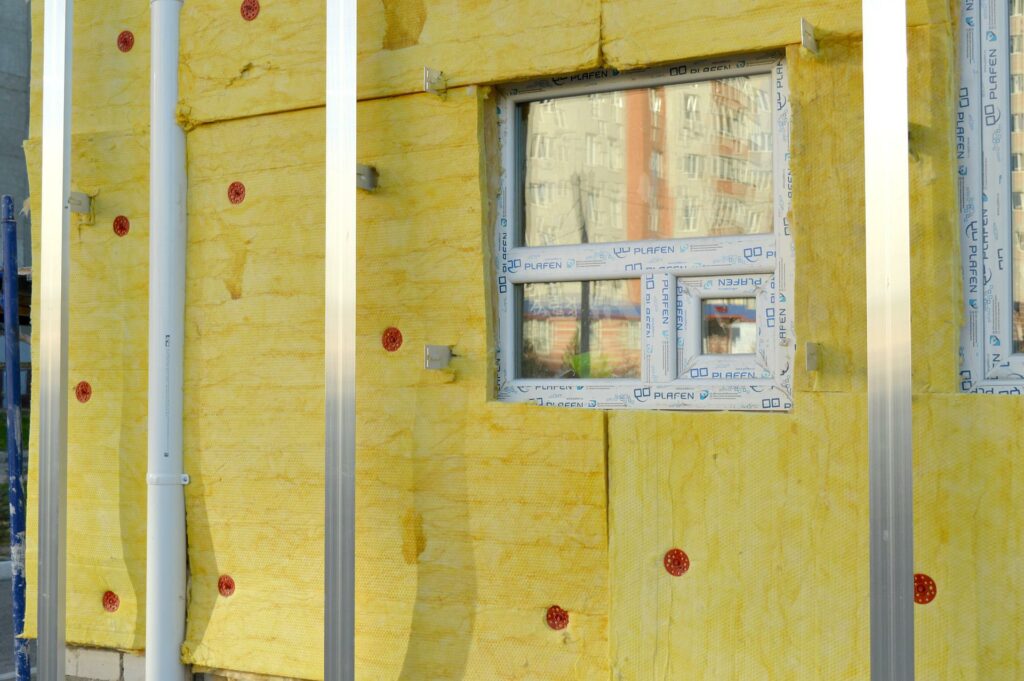

The CO₂ tax on housing is to distribute the burden fairly between landlords and tenants via a graduated model. The proposal from the governing traffic light coalition provides that the share for landlords decreases the better a flat or house is insulated. Tenants would pay almost nothing for uninsulated houses.

Presentation of the relay model on 1 June

On 1 June, the Federal Minister of Economics Habeck (Bündnis 90/Grüne), the Federal Minister of Building Geywitz (SPD) and the Federal Minister of Justice Buschmann (FDP) presented the graduated model as the basis for future burden sharing of CO₂ costs. The graduation based on energy efficiency is intended to motivate landlords to have their properties renovated promptly if they are not yet sufficiently insulated and equipped with outdated heating systems.

Minister of Economics Habeck justified the proposal by saying that tenants have no influence on the energy efficiency of the building and should therefore not be burdened with a higher CO₂ levy in poorly insulated and suboptimally heated houses. Conversely, if a landlord has invested in energy-efficient renovation, he can use the graduated model to pass the costs on to his tenants appropriately. In well-insulated houses, energy costs and CO₂ emissions depend on heating and ventilation behaviour, which in turn is almost exclusively controlled by the tenants. The model therefore seems fair in essence.

Intended steering effect of the graduated model

The graduated model distributes the costs in ten different stages between landlords and tenants. As of June 2022, it has not yet been determined exactly how the calculation will turn out. However, the new calculation system is to be introduced on 1 January 2023, by which time the relevant burdens for landlords and tenants in the individual stages must be communicated. Construction Minister Klara Geywitz justified the fact that this has not yet happened by saying that one did not want to decide on changes in the middle of the current billing period.

As things stand, landlords can pass on the additional costs for the CO₂ levy to tenants in full. The CO₂ price was introduced in 2021, but due to the one-sided burden on tenants, it has so far not been able to have the intended climate policy steering effect. An exception to this is non-residential buildings, where the costs are divided exactly equally between landlords and tenants. Apart from the distribution of costs in the individual stages of the graduated model, it is already clear that the basis for calculation is the CO₂ emissions of a house per square metre of living space. Some key values are also already known: A value of over 52 kg CO₂/m² is considered to be a particularly poor energy balance, at which the landlords must pay 90 % of the CO₂ price. A particularly good value is attributed to the KfW standard EH55, where the CO₂ costs for landlords are to be completely waived.

Phased model as a transitional solution

According to Construction Minister Geywitz, the graduated model presented is a transitional solution based on already known data. This data is already available to landlords and tenants through the heating bill, so there is no need for expert opinions or external calculations. However, the solution currently envisaged and to be worked out in the coming months must be evaluated in more detail.

The goal is to use the energy certificates for the buildings as a basis for calculation in the future. Another economic and ecological goal is to achieve CO₂-neutral heating in the future. Justice Minister Buschmann pointed out that the reduction of fossil fuels requires a legal framework. These must be practicable, and they should also set the necessary incentives, which will undoubtedly succeed with the graduated model. Buschmann pointed out that the model functions with little bureaucracy. It is also easily manageable for private landlords with only one property.

Change requests by tenants and homeowners

Requests for changes to the model came equally from tenants and landlords. The German Tenants’ Association (Deutscher Mieterbund) wants tenants to be completely exempted from CO₂ costs, because these lead to considerable additional burdens, which are likely to increase significantly. The landlords’ association “Haus und Grund” strictly rejects the plan as a whole because it implies a one-sided distribution of the burden to the disadvantage of landlords.

This would also not help climate protection, said Kai Warnecke, head of the association, in an interview with the Rheinische Post. Because of the rising energy prices, the CO₂ price should be increased for the