Battery manufacturer ACC, a joint venture between automotive and energy companies Stellantis, Mercedes-Benz, and TotalEnergies, has definitively abandoned its plans for a gigafactory in Kaiserslautern. At the same time, the consortium is also canceling the battery factory in Termoli, Italy. This effectively ends a project in Kaiserslautern that was intended to provide a boost to local industry and create jobs. (handelsblatt: 07.02.26)

Electric car market falters – the numbers no longer add up

The main reason for the withdrawal is weak demand for electric cars in Europe, because without sales, there’s no capacity utilization for new cell factories. ACC had already slowed down expansion earlier because the market situation no longer provided planning certainty. Now comes the final step, even though battery production is politically considered a key industry.

The Italian metalworkers’ union UILM describes the situation clearly and without ambiguity. ACC management informed employee representatives that the Kaiserslautern and Termoli projects have been “definitively shelved.” This statement sounds like a final decision and puts pressure on the affected sites to take action.

Talks are ongoing, even though the projects have been on hold since 2024

ACC confirms in its own statement that a restart remains unlikely. The necessary conditions are “probably not met,” yet the company is initiating talks about the orderly termination of the projects. ACC speaks of a “constructive dialogue” with works councils in Germany and with unions in Italy.

The timeframe is crucial, as the projects have been on hold since May 2024. What was initially a temporary halt is now becoming a complete cancellation, with consequences for planning, supply chains, and training. For regions that had counted on new industrial jobs, what ultimately matters is not the announcement, but the investment itself.

The union is demanding alternative plans and concrete commitments

The UILM union is calling for “clear and coherent industrial decisions” as compensation. Stellantis had promised production of gearboxes and motors for Termoli, but operational details are still lacking. This leaves open the question of what employment prospects will actually materialize, and uncertainty is growing.

A similar question arises for Kaiserslautern, albeit without a known replacement project. The site is losing a major future prospect, even though the infrastructure and land were already designed for industry. Therefore, the debate about alternatives is intensifying, because time is a critical factor for business location in this sector.

Stellantis Under Pressure: Share Price Plunges and Billions in Write-Downs

The withdrawal comes at a time when Stellantis itself is facing massive headwinds. On Friday, its shares plummeted by 25.2 percent, marking the largest single-day loss in the company’s history. This followed the company’s announcement of write-downs of approximately €22.2 billion and a significant scaling back of its electric vehicle development.

This combination also puts a strain on ACC, as Stellantis is the main investor in the joint venture. When one shareholder cuts costs, the willingness to take risks on new plants diminishes. This shifts the strategy from growth to consolidation, and projects like Kaiserslautern and Termoli are the first to be affected.

France is already producing, but expansion has been halted

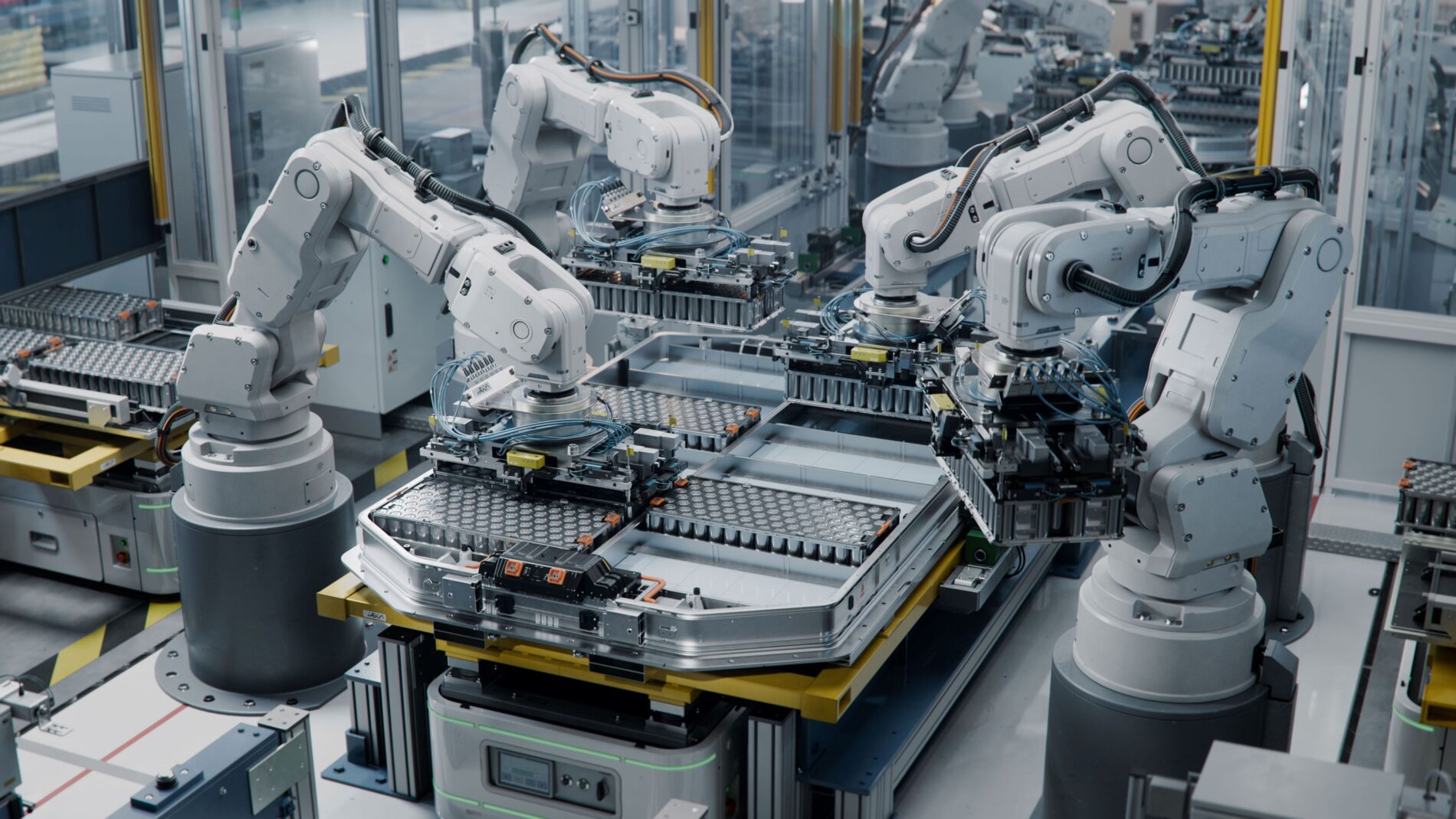

Originally, three ACC factories were planned, with the first plant in France already producing battery cells. The second phase was intended to cover Germany and Italy to meet regional demand in Europe. Now, the expansion plan remains significantly smaller, even though the industry needs large capacities in the long term.

This case demonstrates how quickly industrial policy reaches its limits. Subsidies don’t replace buyers, and without stable demand, there’s no leverage for multi-billion-euro projects. Therefore, ACC’s decision should serve as a warning signal, as it slows down the entire European battery rollout.